And here is how we want to help you get it! Follow the coming articles that will help those who want a refresher course…

Goal Setting Part 1

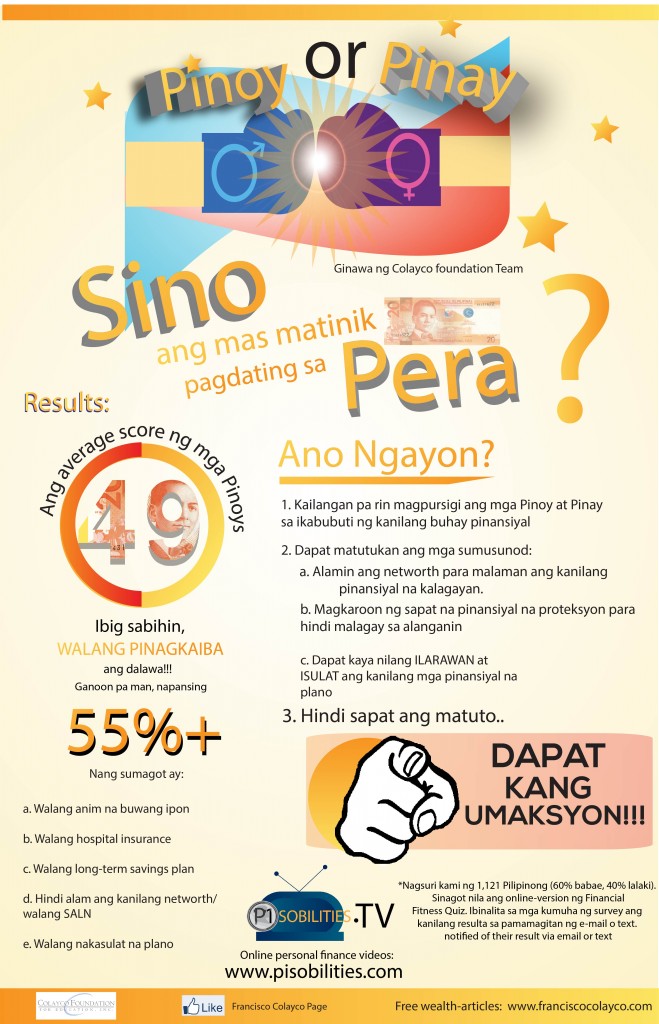

It has been more than eleven years since I started teaching how to care for your personal financial matters. From the many feedback I have received from readers, it is very clear that so many ordinary earning Filipinos do not know how to save and grow their money. The questions I receive are varied and detailed but the most frequent can be summarized into three:

1) How can I save?

2) How can I get into a business?

3) How do I invest in mutual funds?

Before even asking these questions, each person should first set their goals. The New Year is only about 45 days away, it is an opportune time to devote time on GOAL SETTING.

I always remind people that you cannot go anywhere if you do not first establish where you are and where you want to go. My favorite example is when you go to a Mall for the first time and you want to go to a particular store without wasting time because you are in a hurry. You can ask people around you but sometimes, they do not know or worse, they give you the wrong information. The best method is to look at the map in the mall and locate your store and how to go there.

This is the same routine you should follow when you want to save, get into business, or invest your money. When people realize they should save and grow their money, they are suddenly in a hurry to do it without any planning. They start asking around from people they know. Unfortunately, most of the time, they ask people who also do not know how but are so eager to pretend they know. They start getting wrong advice and end up losing money without even knowing how and why.

This need not happen if they followed the rule of GOAL SETTING. The first step is to establish a plan, which is your “map” or your financial goal. Note that most legitimate investments are sound investment instruments. They are all good investments. However, what is important is to be able to tell which one is suitable or best applicable to your needs. It is impossible to be able to discern which is the best for your personal situation unless you have your own financial plan based on your own specific timetable. We will talk more about goal setting in the next articles.

For added information, visit www.colaycofinancialeducation.com www.franciscocolayco.com and www.youtube.com/colaycofoundation at www.kskcoop.com. Tumawag sa 637 3741 o 637 3731 o 0917 863 2131. Our next seminar is on Nov. 28. Join it. Based on experience, we learn more when we have immediate feedback on our questions.

Listen to Pera Mo, Palaguin Mo every Monday on DZXL 558AM from 11am to 12 noon. You can also watch us on Pisobilities Reality every Tuesday, 8:30 pm, on Light Network Channel 33 and every Saturday on GMA News TV 11, 6am.

Or you could be a traditional Filipino who will want to start a family as early as possible. After all, having a child is a wonderful experience and most Filipinos still value the family as its most important wealth. During my time, when life was a lot simpler, we didn’t even think of family planning. Getting married at an earlier age was more normal than it is today. It seemed then that it was automatic to get married, have children and in the process of it all, save for your own home.

Or you could be a traditional Filipino who will want to start a family as early as possible. After all, having a child is a wonderful experience and most Filipinos still value the family as its most important wealth. During my time, when life was a lot simpler, we didn’t even think of family planning. Getting married at an earlier age was more normal than it is today. It seemed then that it was automatic to get married, have children and in the process of it all, save for your own home.