by: Guita T. Gopalan

Whenever I ask people what their investing goals are I’m often answered with silence and a blank face. Making money is not the only goal in investing… In fact, it SHOULDN’T be. With changing markets and global economies, we need to recognize how we are affected — making money (significant money – not the guaranteed less than 1% less taxes and fees from savings accounts) may not become reality and adjust our objectives accordingly. In fact just in the normal course of your financial life your investing needs change.

So what are they?

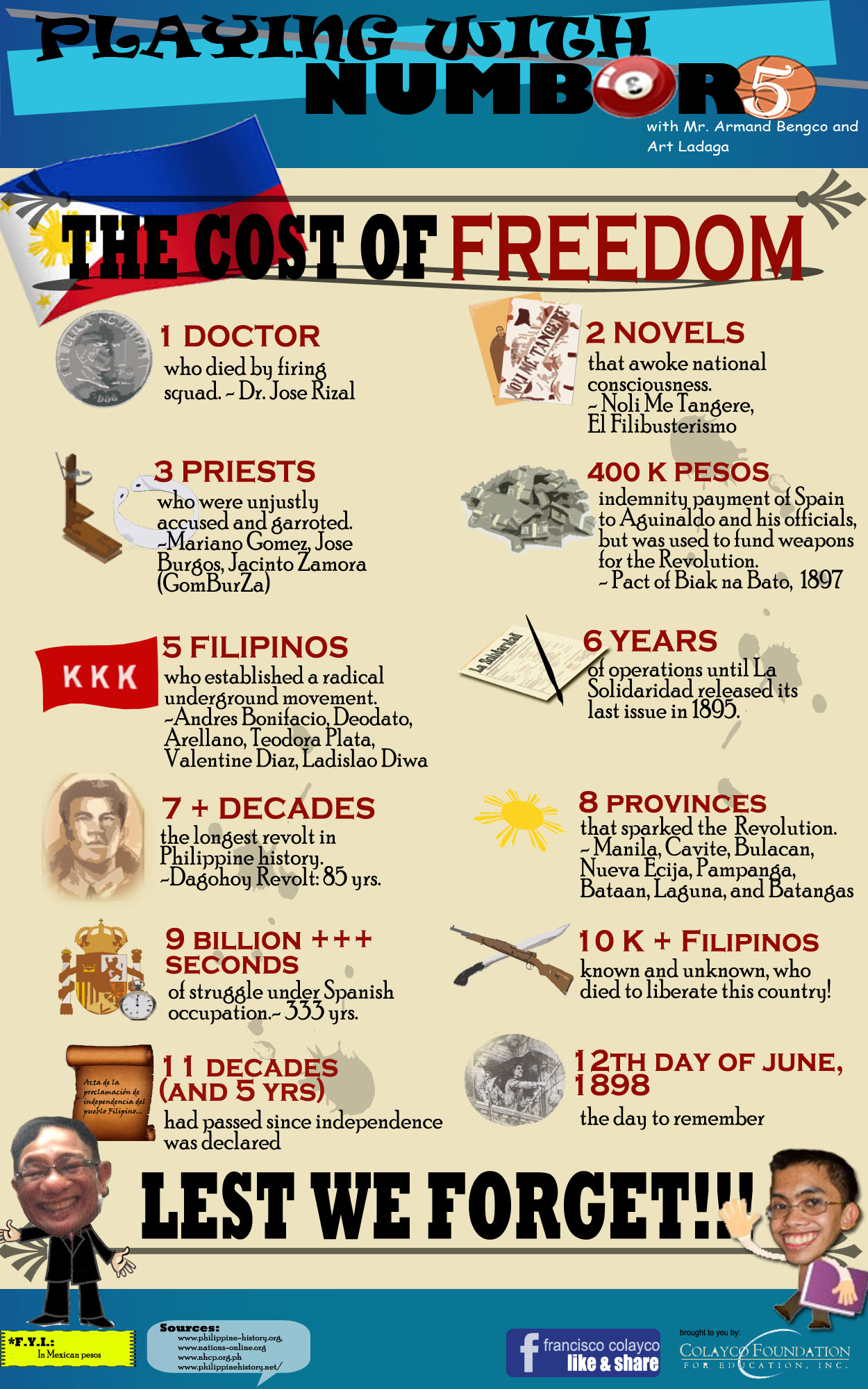

1. Capital Growth– Capital growth is when you want to have a significant increase in the value of an investment over time. Sa simpleng salita gusto mo ng malaking pera! This is best achieved through what we in Colayco Foundation call ownership investments. These are investments which you buy at a certain price and hope to sell at a higher price at a later time. Examples of these are stocks, mutual funds, business, bonds and government securities in the secondary market, real estate, jewelry, art and other collectibles. Investing for capital growth is generally an aggressive move. It requires you to accept high risks in exchange for high returns.

2. Regular Income – When you’re goal is regular income, basically you want to make sure that you get some fixed income every month/quarter/year. It’s very similar (in concept) to you contributing money to SSS for your retirement (investment) and then expecting pension payouts (regular income) when you are retired. Lending investments are best suited for this. Examples of such are deposit accounts, corporate bonds and government securities. Investments (as a financer or share holder) in profitable businesses is also an option. So is having real estate property rented out (or other types of rental business i.e. transport, power tools/machines). Owning preferred stocks or stocks that give regular dividends is also an option. It’s also possible to have a portfolio of investments (many investments – both with ownership and lending investments) where regular income is the objective.

3. Capital Preservation – Markets and economies are like roller coasters on steroids! Keeping your money safe from devaluation (going down in value) may be important, beneficial and even strategic for you. There are some financial instruments which are perfect for this. High interest bearing deposit accounts are most suited for very short time periods. Depending on your investment period you can also consider fixed income and money market mutual funds as well government securities. You won’t get high returns, but you will get some returns and maintain the value of your investment at the same time.

WAIT! There’s one more objective in investing – AVOIDING CATASTROPHIC LOSS

Mr. Colayco calls this ‘every investor’s negative objective.’ According to him, no investor wants his investment to be wiped out. No body wants not just no gain/profits/return but no principal/capital as well. So some tips – straight from the Finance Guru himself, FJC says:

Mr. Colayco calls this ‘every investor’s negative objective.’ According to him, no investor wants his investment to be wiped out. No body wants not just no gain/profits/return but no principal/capital as well. So some tips – straight from the Finance Guru himself, FJC says:

• “A 100% loss starts with 10%” – Cutting your losses can be strategic. Remember its easier to earn back 10% than it is 100%.

• “Detach your persona from your investments” – Many terrible money decisions are a result of hyped up emotions. Make objective decisions and make decisions when you can be objective. You are not your money. And money is only money it can always be earned back!

• “Don’t invest in a scam” and “Stay with the winners. Avoid the losers” – Do your research – you owe it to yourself to invest in ventures/investments that have a chance. Don’t put in money just because your tita offered you the investment/opportunity.

JUST A REMINDER – these goals are not only about one specific investment but also about your whole investment portfolio (having more than one investment). It really depends on your needs and wants. For example, if you have saved up enough for next year’s tuition, you shouldn’t invest that for capital growth as the risk that the value may decline is too high. This is best invested in something that will give you adequate capital preservation. Another example are funds for retirement – regular income to replace one’s salary and to augment pension can be a primary goal, but you may want to invest in a capital growth instrument for your vacation abroad.

*Guita T. Gopalan is the current Managing Director of Colayco Foundation for Education

Bilang paggunita sa Buwan ng Wika, inimbita akong magbigay ng talumpati sa Kongreso ng Wikang Filipino sa Pamantasang Ateneo de Manila noong ika-20 ng Agosto. Ang aking paksa ay tungkol sa papel ng wikang Filipino para sa maunlad na negosyo. Nasa baba ang nilalaman ng aking talumpati. Nandito rin ang mga slides na ginamit ko:

Bilang paggunita sa Buwan ng Wika, inimbita akong magbigay ng talumpati sa Kongreso ng Wikang Filipino sa Pamantasang Ateneo de Manila noong ika-20 ng Agosto. Ang aking paksa ay tungkol sa papel ng wikang Filipino para sa maunlad na negosyo. Nasa baba ang nilalaman ng aking talumpati. Nandito rin ang mga slides na ginamit ko:  Curious about your money habits? Want to know the pro’s and cons of how you handle your money? Why not try the following quiz to find out:

Curious about your money habits? Want to know the pro’s and cons of how you handle your money? Why not try the following quiz to find out:

SON: “Daddy, may I ask you a question?”

SON: “Daddy, may I ask you a question?”