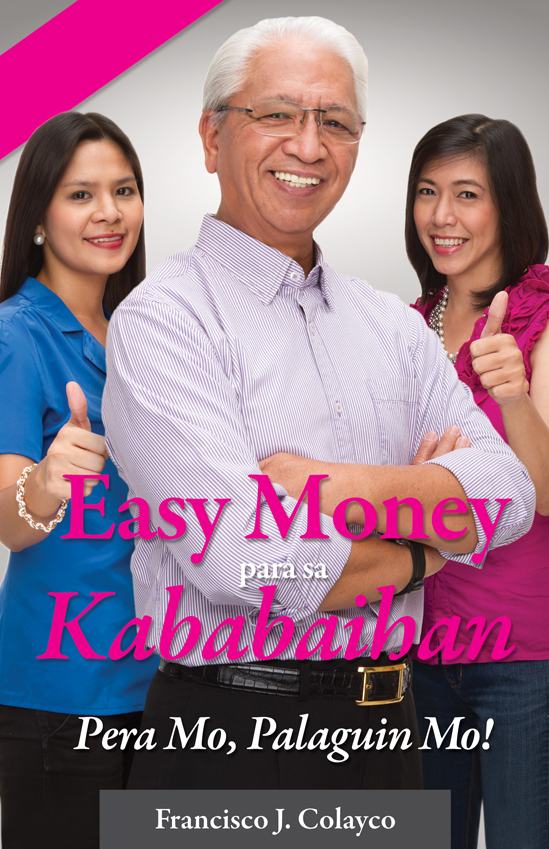

My new book sequel to the books I have written is available in National Bookstore and other bookstores and even directly from us at www.colaycofinancialeducation.com.

The title of the new book comes from the previous books. The first book was “WEALTH WITHIN YOUR REACH. PERA MO, PALAGUIN MO!” The second book was “MAKE YOUR MONEY WORK. PERA MO, PALAGUIN MO!”

This new book title is self-explanatory: “WEALTH REACHED. MONEY WORKED. PERA MO, PINALAGO MO!” The book investigates the lives of the various characters in the first two books and explains what they did in the past eleven years after reading my books and listening to my advice. It will make you believe that, if you had listened then, you would be in a better personal financial condition today.

I hope you were one of those who did listen. If you did not, it is still not too late. Get the book, read and analyze and convince yourself that you can do something. So many people have succeeded with very little required savings. What you need is a lot of Discipline and Determination. You can do it. Don’t wait for another ten years before you again regret that you did not do something. You can do it NOW!

I share with you now the various sharing of people regarding the books.

Mr. Hans B. Sicat,?President and CEO of the Philippine Stock Exchange says:

“Mr. Colayco shares the Philippine Stock Exchange’s vision in promoting a culture of savings and investments in the country. By starting and encouraging employees to save and invest, we are in fact contributing to the financial wellness of our work teams which should hopefully be passed on to their immediate environs and communities.”

Mr. Ignacio B. Gimenez?Chairman and President, PhilEquity Fund, Inc. notes that:

“Wealth Reached, Money Worked” is motivating and informative. After over 10 years in this advocacy, Topax’s message of financial freedom is enriched by the real experience of real people he and the Colayco Financial Education team have enlightened along the way. It really doesn’t take a lot of money and effort to be financially comfortable. The key to building wealth – time, patience and good decision making. More than ever Filipinos need to be wise with their money not just in choosing what to buy or how to spend their hard earned cash but in how to grow it. Easy to read and completely understandable, this book will help Filipinos explore the possibilities open, available and affordable to the ordinary income earning Filipino.”

Mr. Generoso Asuncion who has read the past books says:

“When I read the 2 books “Pera Mo Palaguin Mo 1 & 2” my view in life has changed. Asides from the books, I also watched Mr. Colayco in YouTube and read the articles in the web. He changed my life. I learned how to save money. I also share what I have learned to my kids, friends, my siblings and to the people I meet so they would know the right way to save money and attain financial freedom. Thank you so much Mr. Topax. You are the LIGHT in a dark place of poverty.”

- Cayanong, a?Customer Service Representative, Convergys Philippines in 2013 says:

“I definitely enjoyed learning from Colayco Foundation. It brought a realization of how badly I manage my earnings, but it also opened the opportunity to start NOW. Start saving and investing. It made me aware of the need to secure my self and my family’s future.”

Mary Grace M. Orbase, a student in 2011 said:

“I am a 14 year old high school student soon to be third year high school student, I’ve read your book, Pera Mo Palaguin Mo! 2. It inspired me a lot. It guides me and enlightens me at my tender age. It really awakened me on how to handle my allowance-that there’s always savings. More power and good luck. I hope there will be a lot of high school students like me that will read and will be enlightened with your book :)”

RenzSumera, a?Licensed Chemical Engineer in 2012 said:

“I just graduated with a degree in Chemical Engineering at the age of 21. I am currently looking for a career while at the same time studying for my board exam this November. I have read your two books, Money and Wealth and it really inspired me to value money and learn how to invest. I can’t wait to start earning active income and saving up to 20% of it for good investments. Thank you for writing those books and I hope that more fresh graduates like me or young professionals will read them and be inspired.”

Leonardo Alba, an OFW from Abu Dhabi said:

“I read your book over and over again because I was not able to understand some parts with one pass. But all in all the content was good and it even have matching examples. For now I will try to apply what I have read from your book.”

Cecilia T., 2012 said:

Your books are very informative and has simple information. This is important especially for a woman like me. This book is really a blessing. Natutoakokungpaanoiingatan at mapapalagoang finances ngakingpamilya.

Anthony Pinaglabanan, Iowa said:

Mr. Colayco was the one who influenced me in financial literacy 6 years ago, got some investments now and its working beating inflation and not still focusing to make it happen. My next project is to create passive income as I want to retire early to enjoy time with my family.

RazmonZamboanga, 2006 said:

Thank you for making not only our peramalagobut especially our mind. It was worth the trip from the province to buy your books. I travelled hundreds of kilometers and it had opened a million miles of opportunity and realizations. Talaganglumago. The PeraPalaguin Books made me realize that poverty can be caused by ignorance in managing your finances and not necessarily the inadequacy of financial resources.

SimpeRogie Magana-Co said:

You educate people on how to be financially literate by using simple language and practical examples. You continue to share valuable knowledge and personal experience in money management.

SimpeRogie Magana-Co said:

You educate people on how to be financially literate by using simple language and practical examples. You continue to share valuable knowledge and personal experience in money management.

Sarah Jane Mayola OFW said:

I heard of Colayco Foundation some time back when I was still working as a staff nurse at one of the hospitals in the Kingdom of Saudi Arabia. I didn’t have the chance to start maybe because I was not ready yet or I was not that determined to make a change in my life. Now that I’m back here in the Philippines, I’m applying for a job again overseas. I just realized how important is proper investment and savings. All my savings are gone and for the meantime I’m working as a call center agent here in Makati. I only save Php1000 every payday but I’ve decided to start saving. This time I will set aside and keep my savings.

I hope these statements will help encourage you to read and study my books, if not for yourself, for your family members who have so much to gain by having a good basic education in their personal finance management. Check out www.colaycofinancialeducation.com for more information.

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.