Reminiscing events from 1 year ago and the product of a moment.

I was initially unbelieving that it was me she was calling when Suze Orman invited ”the Filipino author who is present here” to the stage during her February 25 talk (2012).

I do not know Suze Orman personally although I enjoy watching her shows. I did not know that her friend Doris Ho, whom I also just met that morning gave her my set of books when she arrived in Manila. After the short conversation on stage, I sent a text to our Executive Director Armand Bengco, who was at that precise time in Hong Kong talking to our KsK Multipurpose Cooperative members. I texted him that an amazing thing just happened! Suze Orman, Top USA Financial guru invited me to join her on stage this morning as she was giving a talk sponsored by BPI at The Fort. Suze gave a terrific talk and it was almost unbelievable how much she cares for Filipinos and has the same line of thinking in personal financial education as I do. Suze committed to help us educate more Filipinos and I look forward to an active collaboration with her!

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.

_________

FEBRUARY 25, 2013

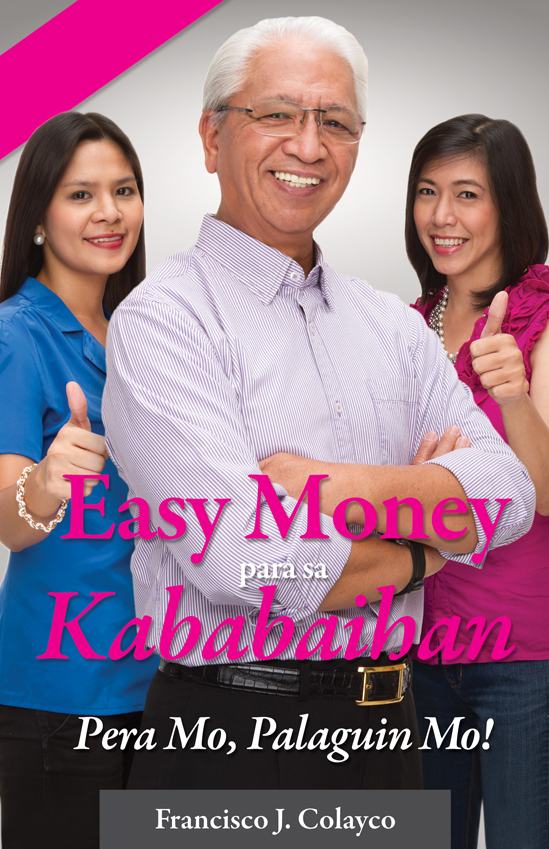

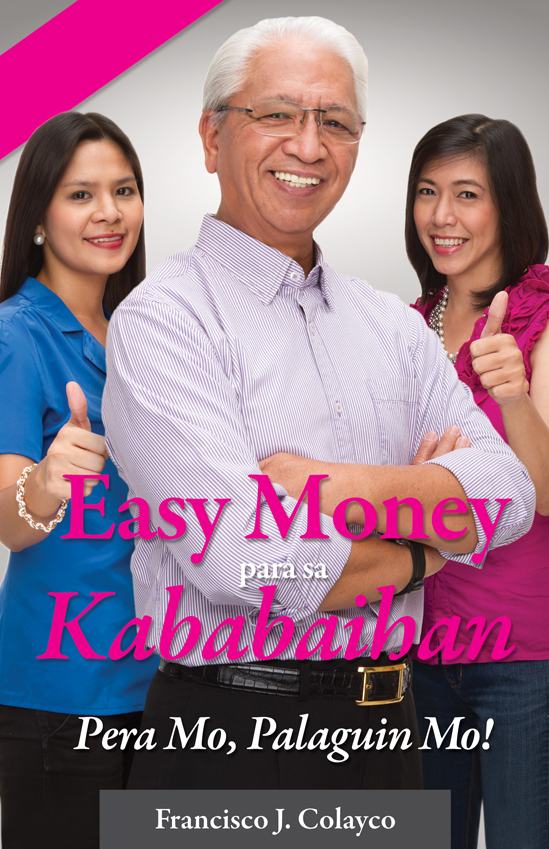

Meeting Suze gave the push needed for a new book to come about – Easy Money Para sa Kababaihan, ang natatanging libro tungkol sa pag-hawak at pagpapalago ng pera na para sa babae!

SRP Php95 – Available very soon in all leading bookstores

SUZE ORMAN GAVE FILIPINOS A MONEY TALK

Published in ENews of Asia Society

March 1, 2012

Suze Orman, America’s most trusted financial advisor, was in town last February 25 to give a talk on taking control over one’s personal financial power. Approximately 700 guests filled the NBC tent Saturday morning to attend the Bank of the Philippine Islands event and listen to the “one-woman financial advice powerhouse” as described by US Today. A two-time Emmy-Award winning television host, she was in Manila to keep a promise made to her friend Doris Magsaysay-Ho, chairwoman of Asia Society Philippines, to help and inspire Filipinos in their need for financial literacy.

“Hope is not a financial plan,” stated Orman who highlighted the jackpot-mentality that some Filipinos have when it comes to their money. One shouldn’t rely on the lottery and simply hope for the best or simply keep the money in your house safe and sound; you need to take control of the opportunities available when it comes to your finances.

Having been raised in an unruly neighborhood on the south side of Chicago, Orman was no stranger to poverty. She used to live in her car and waited on tables earning $400 a month for seven years until she dreamed of owning a restaurant of her own at the age of 30. Having heard her dream, one of her regular customers collected the contributions of other customers tantamount to $50,000 to lend to her for 10 years without interest. She took her money to Merrill Lynch to put in a money market account but the broker made her sign papers to make it seem like she was a sophisticated investor who was qualified to invest in stock options. Within three months, she lost the money.

Realizing she couldn’t pay back the $50,000 with her job as a waitress, she applied as a broker at Merrill Lynch and was hired due to the affirmative action that the company had to hire women. However, her boss informed her she would be fired in 6 months.

Studying as a broker, she learned that it was part of law as a broker not to invest someone’s money in a way that he/she could not afford to invest it. She proceeded to sue Merrill Lynch for the bad handling of her $50,000 and because of the ongoing case, Merill Lynch could not fire her.

“Always do what is right than what is easy,” she said. The broker who lost her money was let go, her boss moved on and in 2 years she became one of Merill Lynch’s top producers and earned her $50,000 back with 18% interest.

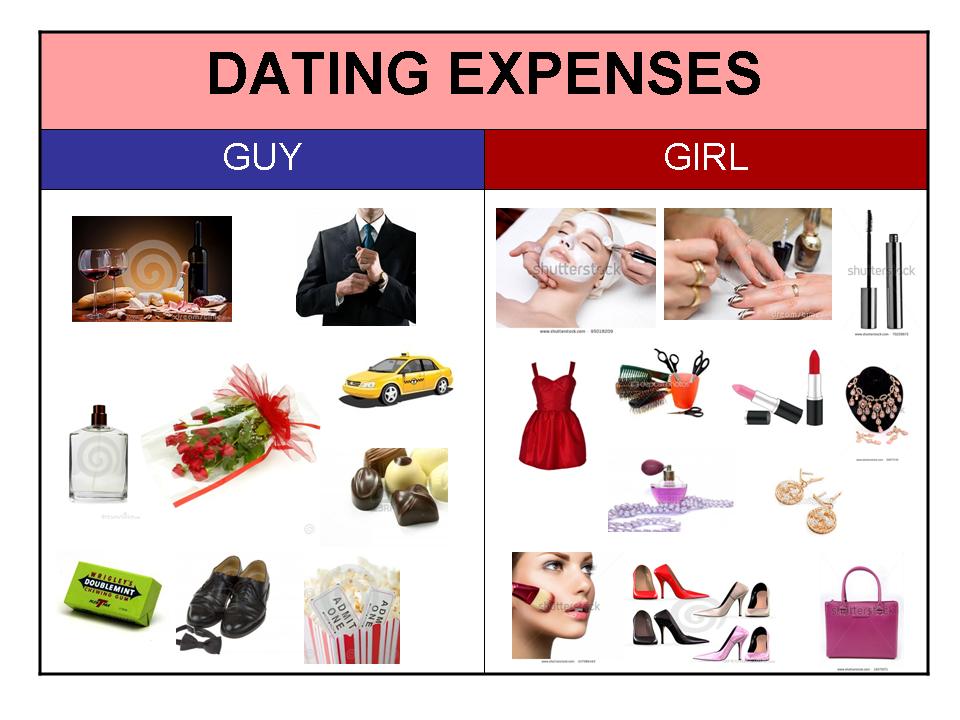

For young people and their finances, Orman expressed the importance of saving a portion of their earnings regularly as early as possible. “The quickest way to get rich is to get rich slow.” stated Francisco Colayco, a well-known author who was brought to the stage by Orman herself. There isn’t a get-rich-quick formula to achieving one’s wealth, but wealth can be gained by saving and investing continously slowly but surely.

On the Philippines, Orman stated we shouldn’t go the way of the US where they allowed their economy to grow on credit, lending to people who could not afford to pay it back. “Build this country on cash so that it could never collapse, then you can change lives,” she said.

Orman’s talk and very first appearance in the country that day to the 700 guests and employees of BPI indeed proved to be a success. Her message has provided inspiration to those who seek to gain financial freedom.

kailangan mong harapin ang katotohanan at isipin kung saan kukuha ng perang pambayad. Sa puntong ito, maghanda kang ibenta ang kahit anumang pag-aari mo. Isipin nang mabuti kung ano ang pwede mong ibenta para mabayaran ang utang. Posibleng gustuhin mo na maging optimistiko at maghintay na lang tutal maaayos din ang lahat. Pero sa katunayan, bawat araw na nagdadaan, lumalaki ang utang mo dahil hindi tumitigil ang pagpatong ng interes at mga multa.

kailangan mong harapin ang katotohanan at isipin kung saan kukuha ng perang pambayad. Sa puntong ito, maghanda kang ibenta ang kahit anumang pag-aari mo. Isipin nang mabuti kung ano ang pwede mong ibenta para mabayaran ang utang. Posibleng gustuhin mo na maging optimistiko at maghintay na lang tutal maaayos din ang lahat. Pero sa katunayan, bawat araw na nagdadaan, lumalaki ang utang mo dahil hindi tumitigil ang pagpatong ng interes at mga multa.

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.